Vacancy to Viability: The Coworking Model as a Solution for Empty Office Buildings - CoworkingConsulting.com

- Home

- Commercial Real Estate

- Vacancy to Viability: The Coworking Model as a Solution for Empty Office Buildings

- By: Your Coworking Advisor

- Commercial Real Estate, Coworking Trends, Featured

- 0 Comments

Introduction to the Vacancy Challenge

Cities across the globe have witnessed a marked increase in vacancy rates, a trend that has persisted and intensified in the post-pandemic era. This surge in empty office spaces presents a complex challenge, not only from an economic standpoint but also in terms of urban development and societal impact.

The implications of these vacancies extend far beyond the confines of unused square footage. Economically, they represent a significant underutilization of assets, leading to decreased property values and eroding the tax base that supports municipal services. Socially, the abundance of vacant buildings contributes to a sense of urban decay, deterring investment and development in surrounding areas. For the CRE sector, this situation underscores a pressing need for innovative strategies to revitalize these spaces and restore their value.

As cities and the CRE industry grapple with the reality of this vacancy challenge, the coworking model emerges as a beacon of potential. Once regarded as a niche offering for freelancers and startups, coworking spaces have evolved into dynamic environments that cater to a broad spectrum of the workforce. Their appeal lies in the flexibility, community, and collaboration they foster, positioning coworking as a strategic solution capable of transforming empty office buildings into vibrant, productive hubs.

This shift towards coworking is not merely a trend but a reflection of changing work patterns and preferences. The pandemic has accelerated the adoption of remote and flexible work arrangements, further diminishing the demand for traditional office spaces. In response, CRE asset managers are increasingly recognizing the value of coworking as an avenue to reinvigorate vacant properties, turning a challenge into an opportunity for innovation, revitalization, and growth. As we delve deeper into the coworking model, its strategic benefits, and the process of implementation, it becomes clear that the untapped potential of empty office spaces is vast, awaiting those ready to explore and embrace new possibilities in the landscape of work.

Understanding the Coworking Model

The coworking model represents a significant evolution from traditional office environments, offering a flexible and communal approach to workspace design and management. At its core, coworking spaces provide a shared working environment where individuals and businesses—from freelancers and small startups to large corporations—can rent desks or offices on a flexible basis. This model is predicated on the idea of community and collaboration, offering tenants not just physical space but a network of potential collaborators, partners, and clients.

Diverse Tenant Appeal

One of the defining characteristics of coworking spaces is their broad appeal. Initially popular among freelancers and digital nomads for their flexibility and networking opportunities, coworking spaces have increasingly attracted a wider audience. Large corporations, for example, now utilize coworking spaces to provide their employees with more flexible working options, to establish satellite offices, or to foster innovation by placing teams in creative and entrepreneurial environments. This wide tenant base benefits asset managers by diversifying occupancy and reducing the reliance on single, large tenants.

Designed for Productivity and Innovation

Coworking spaces are meticulously designed to enhance productivity and foster innovation. Unlike the uniform cubicles and closed-door offices of traditional workspaces, coworking environments often feature open-plan layouts, communal tables, private booths, meeting rooms, and lounge areas. This variety accommodates different work styles and tasks, from collaborative projects and client meetings to deep focus work. Additionally, many coworking spaces are equipped with state-of-the-art technology and amenities, further enhancing the work experience for their members.

Building a Community

At the heart of the coworking model lies the emphasis on building a strong, vibrant community. Coworking operators actively curate events, workshops, and networking opportunities that bring members together, facilitating knowledge exchange and collaboration. This community aspect is not only a key differentiator from traditional office leases but also a critical value proposition for tenants seeking more than just a workspace. For CRE asset managers, fostering such a community within their properties can enhance tenant satisfaction and loyalty, contributing to a stable and engaged tenant base.

Flexibility and Scalability

Flexibility is another hallmark of the coworking model, both in terms of physical space and lease terms. Members can often choose from various membership options, ranging from hot desks accessible on a day-to-day basis to dedicated desks or private offices with longer-term commitments. This scalability allows businesses to adjust their space requirements as they grow or contract, providing a level of agility that traditional leases cannot match. For asset managers, offering such flexibility can make their properties more attractive to a wider range of potential tenants, ensuring higher occupancy rates and a dynamic, adaptable revenue model.

In summary, the coworking model offers a multifaceted approach to workspace management that aligns with the evolving needs of today’s workforce. By understanding and embracing this model, CRE asset managers have the opportunity to transform empty office buildings into thriving hubs of productivity, innovation, and community.

Coworking as a Strategic Solution

The surge in vacant office spaces presents not just a challenge but a strategic opportunity for CRE asset managers to innovate and adapt to the changing landscape of work. The coworking model emerges as a powerful solution, capable of transforming underutilized office buildings into bustling community hubs. This section delves into how coworking spaces not only attract a diverse range of tenants but also generate sustainable revenue, revitalizing empty office spaces and redefining them as centers of productivity and collaboration.

Transforming Spaces, Driving Value

At the core of the coworking proposition is the transformation of traditional office environments into spaces that are not only functional but also inspiring. By converting empty office buildings into coworking spaces, CRE asset managers can address the critical issue of high vacancy rates, turning potential liabilities into profitable assets. Coworking spaces offer a unique blend of open work areas, private offices, and communal lounges, designed to meet the needs of today's dynamic workforce. This adaptability makes coworking spaces highly attractive to a wide range of tenants, from freelancers and startups to established corporations seeking flexible workspace solutions.

Attracting Tenants and Generating Revenue

The coworking model is uniquely positioned to capitalize on the growing demand for flexible workspaces. By offering short-term leases, diverse workspace options, and a community-focused environment, coworking spaces can attract tenants more effectively than traditional office leases. This approach not only fills vacant spaces but also creates a diversified tenant base, reducing the financial risk associated with dependency on a single or few tenants. Moreover, the vibrant community and networking opportunities inherent in coworking spaces enhance tenant retention, contributing to a stable and continuous revenue stream.

Beyond Space: Building Communities

One of the most significant advantages of the coworking model lies in its ability to foster a sense of community among its members. Coworking spaces are not just about providing a desk or an office; they're about creating an ecosystem where members can collaborate, share ideas, and grow together. This community aspect is a key differentiator, offering value that goes beyond the physical space. For CRE asset managers, investing in the development of coworking spaces means investing in the creation of dynamic professional communities that can drive innovation and business growth.

Strategic Considerations for Implementation

Implementing the coworking model requires careful planning and strategic consideration. Asset managers must assess the suitability of their properties for coworking conversions, considering factors such as location, existing amenities, and potential demand. Design and layout plans should prioritize flexibility and foster a collaborative atmosphere, incorporating elements that encourage interaction and productivity. Operational strategies, including marketing, pricing, and community engagement, must also be tailored to ensure the coworking space aligns with market needs and business objectives.

The coworking model offers CRE asset managers a strategic solution to the challenge of empty office spaces, providing a viable path to revitalization and monetization. By transforming vacant buildings into coworking hubs, asset managers can attract a diverse tenant base, generate stable revenue, and build vibrant professional communities. As the workplace continues to evolve, the coworking model stands as a testament to the power of flexibility, innovation, and community in redefining the value of office real estate.

Case Studies: Successful Transformations

The transition of vacant office spaces into thriving coworking environments is not merely theoretical; numerous real-world examples highlight the practical success and transformative impact of such initiatives. Here, we present case studies that illuminate the paths taken and the outcomes achieved, demonstrating the strategic and economic viability of the coworking model for CRE asset managers.

Case Study 1: Revitalizing Downtown Houston

Background: Faced with a 26.3% office vacancy rate, a historic high for the city, a CRE asset manager in Houston embarked on an ambitious project to convert a dated, underutilized office building into a modern coworking space.

Strategy: The project leveraged the building's prime location and existing infrastructure, introducing flexible workspace layouts, state-of-the-art technology, and community-focused amenities. A phased deployment model was employed, allowing for immediate market entry and gradual expansion based on member feedback and demand.

Outcome: Within the first year of operation, the coworking space achieved over 80% occupancy, attracting a diverse mix of tenants, including tech startups, freelance professionals, and satellite teams from established corporations. This success not only enhanced the property's value but also contributed to the revitalization of the surrounding downtown area.

Case Study 2: Bridge+ Ascent in Singapore

Background: As part of Ascendas-Singbridge’s portfolio, Bridge+ aimed to create a coworking ecosystem that supported innovation and collaboration within Singapore’s bustling Science Park.

Strategy: By integrating flexible workspaces with collaborative areas for interaction, Bridge+ focused on creating a vibrant community. The inclusion of contemporary facilities and access to Ascendas-Singbridge’s Asia-wide network of business parks provided unparalleled resources and networking opportunities for members.

Outcome: Bridge+ quickly became a hub for entrepreneurs, venture capitalists, and tech companies, significantly reducing vacancy rates in the area. Its success led to expansion across Asia, demonstrating the model's scalability and the broader appeal of coworking spaces as engines of economic transformation and community enrichment.

Case Study 3: A Micro Leasing Revolution in Austin

Background: In response to Austin's burgeoning tech scene and its resulting office space demand fluctuations, a CRE asset manager decided to implement a micro leasing strategy within a newly developed coworking space.

Strategy: The space offered a mix of micro leases, from hot desks to private offices, with the flexibility to scale up or down based on tenant needs. This approach was complemented by a robust community engagement program, fostering a collaborative environment that appealed to a broad spectrum of businesses.

Outcome: The coworking space quickly reached full occupancy, with a waiting list for membership. The micro leasing strategy not only addressed the high vacancy rate challenge but also established the coworking space as a premier location for innovation and collaboration in Austin's competitive market.

These case studies underscore the coworking model's potential to transform empty office spaces into dynamic, community-driven environments. By adopting innovative approaches—whether through internal competency development, strategic partnerships, or micro leasing strategies—CRE asset managers can revitalize properties, enhance asset value, and contribute to vibrant urban ecosystems. The success stories of Houston, Bridge+ Ascent in Singapore, and Austin's coworking space revolution serve as compelling evidence of the coworking model's role in reshaping the future of office real estate.

Implementing the Coworking Model

For CRE asset managers looking to convert traditional office spaces into coworking environments, the implementation process is critical to ensuring the success and sustainability of the coworking space. This section outlines key steps and considerations for CRE asset managers embarking on this transformative journey, focusing on design, operational management, and community engagement.

Assessing Property Suitability

- Location Analysis: Evaluate the property's location for accessibility, proximity to amenities, and potential demand for coworking spaces. Ideal locations are those that offer ease of access for commuters and are situated near vibrant community hubs.

- Building Infrastructure: Assess the existing infrastructure for suitability. Coworking spaces require robust internet connectivity, flexible power solutions, and efficient HVAC systems to accommodate varying occupancy levels.

- Market Demand: Conduct market research to understand the specific needs and preferences of potential coworking tenants in your area. This could involve surveys, focus groups, or analysis of competitor offerings.

Designing for Flexibility and Collaboration

- Flexible Workspace Layouts: Design spaces that can easily be reconfigured to accommodate different work styles and activities, from open-plan coworking areas to private offices and meeting rooms.

- Amenities and Services: Incorporate amenities that enhance productivity and well-being, such as communal kitchens, wellness areas, and leisure spaces. High-quality, reliable Wi-Fi and printing services are non-negotiable.

- Branding and Aesthetics: Ensure the coworking space reflects a strong brand identity that resonates with your target market. The aesthetic should be modern, inviting, and conducive to creativity and collaboration.

Operational Management and Technology Integration

- Membership Models: Develop flexible membership plans that cater to various needs, from daily passes to monthly memberships and dedicated office spaces.

- Technology Platforms: Implement a coworking management software that facilitates booking, billing, member communication, and access control. Technology should enhance the user experience and operational efficiency.

- Community Engagement: Appoint a community manager responsible for fostering a vibrant coworking community. This involves curating events, workshops, and networking opportunities that encourage collaboration and connection among members.

Overcoming Implementation Challenges

- Regulatory Compliance: Navigate zoning laws and building codes that may impact the development of coworking spaces. Early consultation with local authorities can prevent potential setbacks.

- Budgeting and Financial Planning: Accurately budget for the initial buildout and ongoing operational costs. Consider potential revenue streams beyond membership fees, such as event space rentals and ancillary services.

- Adapting to Market Changes: Stay attuned to evolving market trends and tenant expectations. The ability to adapt and innovate is crucial in the dynamic coworking industry.

A Path to Revitalization

Implementing the coworking model offers CRE asset managers a strategic opportunity to revitalize vacant office spaces, create vibrant work communities, and respond to the evolving demands of the modern workforce. By carefully assessing property suitability, designing flexible and collaborative environments, and managing operations effectively, asset managers can transform empty office buildings into thriving coworking spaces. This not only addresses the challenge of high vacancy rates but also positions CRE portfolios for future growth and success in the changing landscape of work.

Economic and Social Benefits

The transition from vacant office spaces to active coworking environments transcends mere property utilization—it heralds significant economic and social advantages for cities, the commercial real estate sector, and the broader community. This transformation not only revitalizes underused assets but also stimulates local economies, fosters innovation, and cultivates vibrant professional communities. Here, we explore the multifaceted benefits of reducing office space vacancy through the coworking model.

Stimulating Local Economies

The activation of coworking spaces in previously vacant office buildings injects vitality into local economies. These spaces attract a diverse mix of entrepreneurs, freelancers, startups, and even established businesses, all of whom contribute to the economic ecosystem. The presence of these professionals increases demand for local services and amenities, including restaurants, cafes, retail shops, and public transportation, thereby supporting small businesses and generating additional tax revenue for the city.

Fostering Innovation and Entrepreneurship

Coworking spaces serve as incubators for innovation and entrepreneurship. By providing a collaborative environment equipped with resources and networking opportunities, these spaces enable individuals and companies to share ideas, collaborate on projects, and accelerate business growth. This ecosystem of innovation not only contributes to the economic dynamism of the area but also positions the city as a hub for technological advancement and creative solutions.

Enhancing Social Capital and Community Engagement

The coworking model emphasizes community and connectivity, contributing to the social fabric of the urban landscape. These spaces offer more than just a place to work; they create communities where professionals can engage, learn from one another, and build lasting relationships. This enhanced social capital fosters a sense of belonging and support among members, contributing to their personal and professional well-being. Moreover, coworking spaces often host events, workshops, and social gatherings that are open to the broader community, encouraging engagement and collaboration beyond their walls.

Revitalizing Urban Spaces

The conversion of empty office buildings into coworking spaces plays a crucial role in urban revitalization. It breathes new life into neglected or underutilized areas, transforming them into attractive destinations for businesses and professionals. This revitalization can spark further investment and development in the surrounding area, leading to urban renewal and improved infrastructure. By repurposing vacant spaces, CRE asset managers contribute to the aesthetic, economic, and social enhancement of urban environments.

Creating Sustainable Work Environments

Coworking spaces often prioritize sustainability and eco-friendly practices, from green building designs and energy-efficient operations to recycling programs and sustainable sourcing. This commitment to environmental stewardship not only reduces the carbon footprint of office buildings but also aligns with the growing demand for sustainable work environments among today's workforce. By fostering eco-conscious coworking spaces, CRE asset managers can lead by example, promoting sustainability in the commercial real estate industry and contributing to the broader goal of environmental preservation.

A Catalyst for Positive Change

In summary, reducing office space vacancy through the development of coworking environments yields significant economic and social benefits. It stimulates local economies, fosters innovation, enhances social capital, revitalizes urban spaces, and promotes sustainability. As CRE asset managers embrace the coworking model, they position themselves as catalysts for positive change, contributing not only to the success of their portfolios but also to the well-being of communities and the environment. The coworking revolution is more than just a response to vacancy challenges—it's a movement towards a more connected, innovative, and sustainable future.

Challenges and Considerations

As CRE asset managers explore the integration of coworking spaces into their portfolios, several challenges and considerations emerge. These hurdles often pertain to regulatory compliance, market alignment, and operational complexities. However, with strategic planning and informed decision-making, these challenges can be navigated successfully. Here, we outline common obstacles and propose solutions to enable a smooth transition from traditional office models to vibrant coworking environments.

Regulatory Compliance and Zoning

Challenge: Navigating the maze of zoning laws and building codes can be daunting. Regulatory requirements may vary significantly across locations, potentially complicating the conversion process.

Solution: Early engagement with local authorities and legal experts specializing in real estate development is crucial. This proactive approach ensures that any regulatory hurdles are identified and addressed early in the planning phase, minimizing delays and ensuring compliance.

Market Alignment and Demand Assessment

Challenge: Misalignments between the coworking concept and local market demands can lead to underutilization of the space. Understanding the specific needs of potential members is essential for creating a coworking environment that resonates with the target audience.

Solution: Conduct thorough market research to gauge demand for coworking spaces in the intended area. Surveys, focus groups, and competitive analysis can provide valuable insights into the preferences and requirements of potential coworkers, enabling asset managers to tailor the coworking offering accordingly.

Financial Viability and Budget Management

Challenge: Developing a coworking space requires significant financial investment, with costs associated with renovations, technology integration, and operational setup. Ensuring the project's financial viability is paramount.

Solution: Comprehensive financial planning, including detailed budgeting and revenue forecasting, is essential. Consider leveraging financial models that account for various occupancy scenarios and potential revenue streams. Additionally, exploring financing options and potential partnerships can provide the necessary capital support.

Operational Complexity and Community Building

Challenge: Operating a coworking space involves complex logistical and operational challenges, from membership management to event programming. Additionally, building a cohesive community within the coworking space is a nuanced process that requires dedicated effort.

Solution: Investing in specialized coworking management software can streamline operational tasks, from booking spaces to billing members. Hiring experienced community managers who can foster engagement, organize events, and maintain a vibrant coworking culture is also critical.

Branding and Differentiation

Challenge: In a market increasingly saturated with coworking offerings, differentiating the space to attract members can be challenging. Establishing a strong brand identity and unique value proposition is vital.

Solution: Focus on creating a unique coworking experience that emphasizes the space's distinctive features, location advantages, and community benefits. Effective branding and marketing strategies, coupled with high-quality services, can set the coworking space apart in a competitive market.

Looking Forward

Navigating the challenges of integrating coworking spaces into CRE portfolios requires careful planning, strategic insight, and adaptability. By addressing regulatory, market, financial, operational, and branding considerations, asset managers can unlock the full potential of coworking as a solution for vacant office spaces. Embracing coworking not only revitalizes underutilized properties but also positions CRE portfolios for future success in an evolving real estate landscape, showcasing the untapped potential of empty office spaces as a strategic asset in the modern work environment.

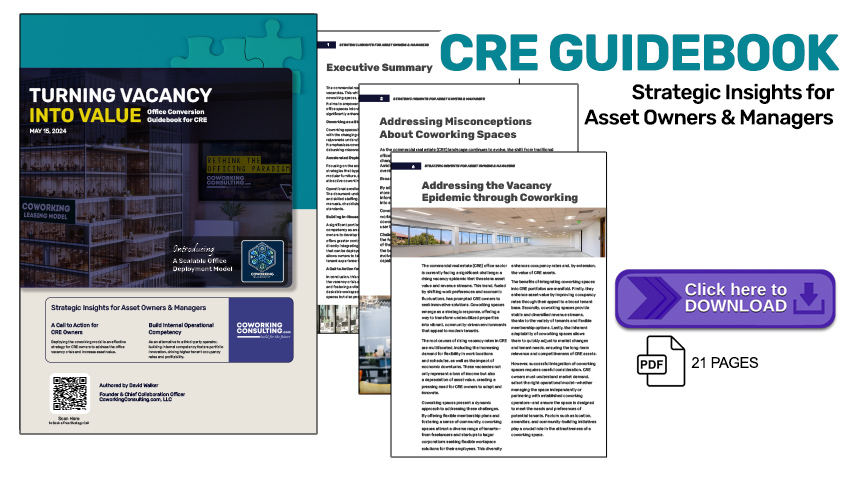

The journey through the evolving landscape of commercial real estate (CRE), particularly in navigating the challenges of vacant office spaces, reveals a compelling narrative of adaptation, innovation, and community building. This guide, "The Untapped Potential of Empty Office Spaces: A Strategic Guide for CRE Asset Managers," has underscored the transformative power of the coworking model as a strategic solution to revitalize underutilized properties and enhance the value of CRE portfolios.

As we look to the future, the potential of coworking spaces to address office space vacancies is immense. The evolution from traditional office models to dynamic, community-centric coworking environments is not merely a trend but a pivotal shift in the way we conceive of and utilize workspace. For CRE asset managers, the decision to develop coworking competencies internally or partner with third-party operators presents a strategic opportunity to align with the changing dynamics of the workforce and the market.

The misconceptions surrounding coworking, particularly its appeal beyond small users, are gradually being dispelled. Coworking spaces have proven their value in catering to a wide range of tenants, from individual freelancers to major corporations, each seeking flexibility, innovation, and a sense of community. The introduction of micro leasing strategies further amplifies this appeal, offering CRE asset managers a novel approach to leasing that mirrors the adaptability and convenience of coworking.

The journey ahead for CRE asset managers involves a careful consideration of accelerated versus traditional deployment models, each with its own merits and challenges. The choice between these models will significantly impact the speed to market, flexibility, and alignment with tenant needs. Yet, regardless of the path chosen, the implementation of coworking spaces promises not only to breathe new life into vacant office buildings but also to redefine them as vibrant hubs of productivity and collaboration.

The coworking model stands as a beacon of innovation in the CRE sector, offering a viable and strategic solution to the challenge of high vacancy rates. As asset managers embrace this model, integrating professional development, community engagement, and innovative leasing strategies, they unlock new avenues for growth and success. The transformation of empty office spaces into coworking hubs is not just about filling vacancies—it's about creating environments that inspire, connect, and elevate, paving the way for a thriving, resilient, and interconnected future in commercial real estate.